SynOx Therapeutics Limited (“SynOx”), a late-stage clinical biopharmaceutical company developing of emactuzumab for Tenosynovial Giant Cell Tumours (TGCT), today announced the execution of a planned and orderly transition of its...

Investment philosophy

Gilde Healthcare invests in businesses enabling better care at lower cost.

40

years in business

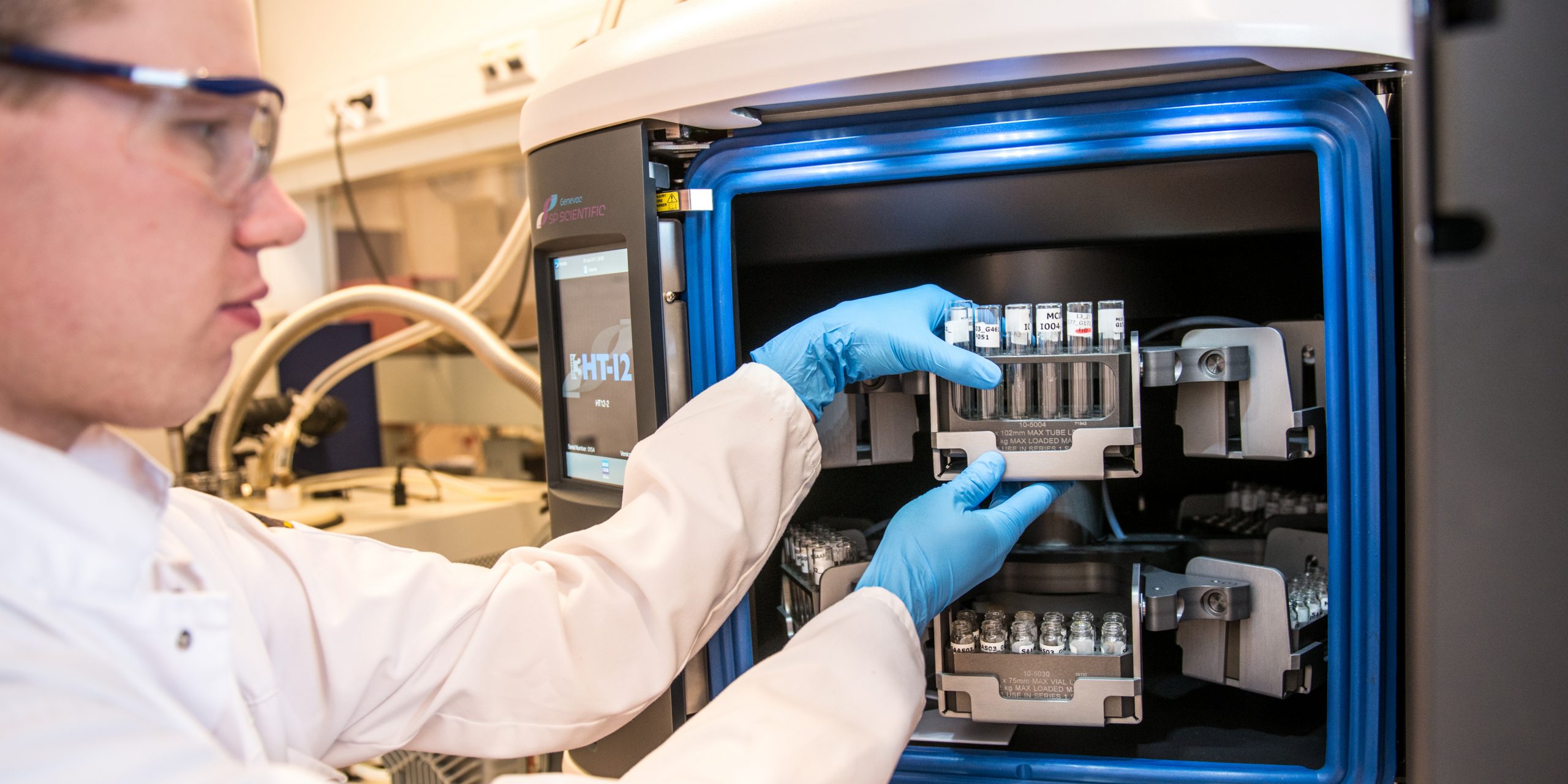

Venture&Growth

Gilde Healthcare Venture&Growth invests in healthtech and therapeutics. The Venture&Growth fund supports fast growing companies in Europe and North America.

68

Venture&Growth companies in portfolio

under management

2.6B

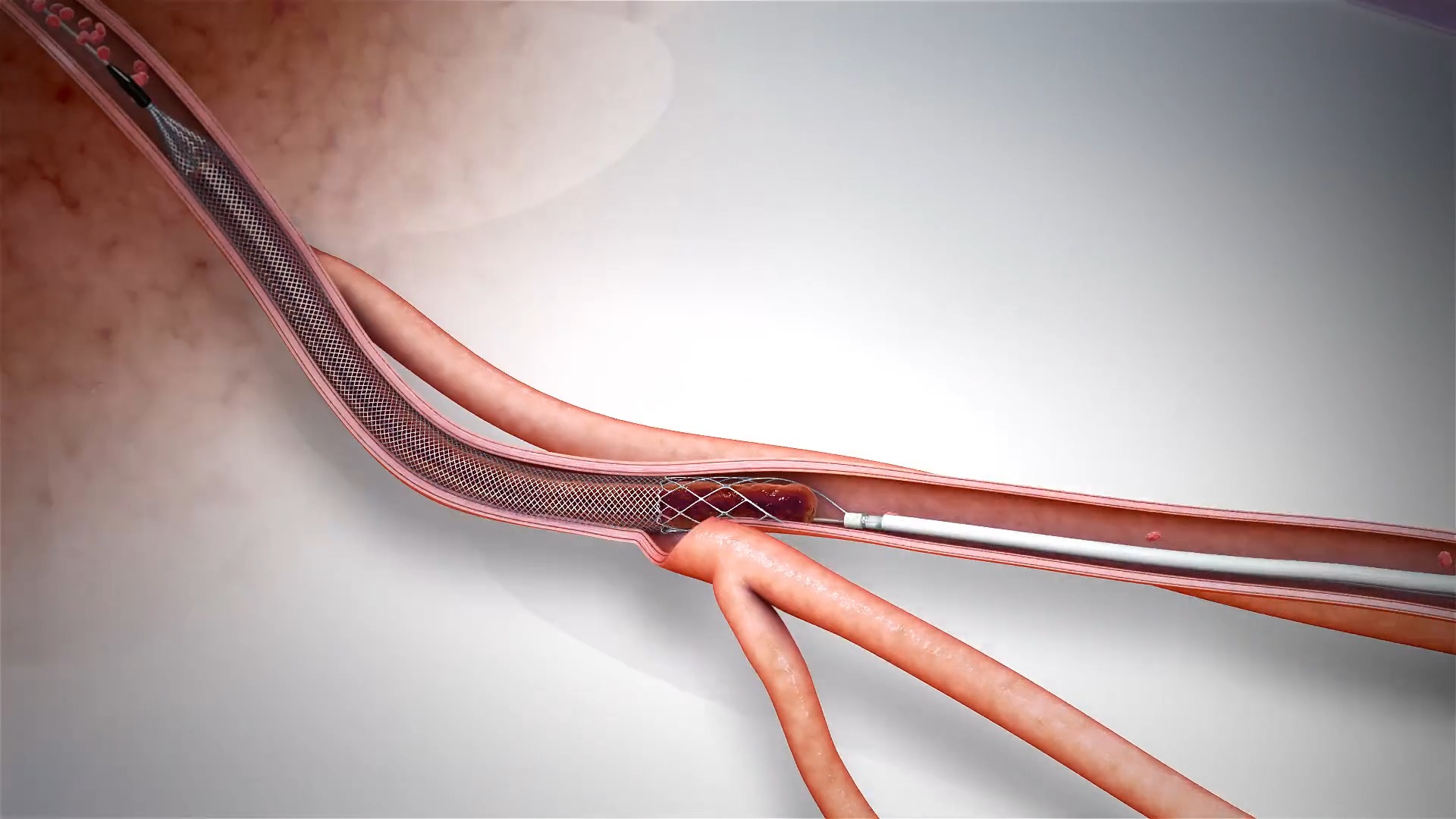

Private Equity

Gilde Healthcare Private Equity participates in profitable European lower mid-market healthcare companies. The Private Equity fund targets healthcare providers, suppliers of medical products and service providers to the healthcare sector.

23

Private Equity companies in portfolio

portfolio

40

years in business

68

Venture&Growth companies in portfolio

under management

2.6B

23

Private Equity companies in portfolio

portfolio

Responsible Investment at Gilde Healthcare:

We focus on both ESG and Impact: ESG sets the foundation with responsible practices, while Impact drives measurable change in healthcare. Check out our impact cases to see how we’re making a difference.

Read more about ESG/impactNews

Keep up to date with Gilde Healthcare announcements and portfolio company news.